Thursday, April 27th, 2023

Smarttech247 Announces Interim Financial Results

Certain information contained within this Announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulation (EU) No. 596/2014 (“MAR”) as applied in the United Kingdom. Upon publication of this Announcement, this information is now considered to be in the public domain.

Smarttech247 Group PLC

(“Smarttech247”, the “Group” or the “Company”)

Interim results

Smarttech247 (AIM: S247), a multi-award-winning provider of AI-enhanced cybersecurity services providing automated managed detection and response for a portfolio of international clients, today announces its maiden unaudited interim results for the six months ending 31 January 2023.

Operational highlights

· Admitted to trading on AIM in December 2022 raising £3.7 million via a placing of new ordinary shares

· Continued growth of the customer base in the UK, Europe and the US

· Multiple new contracts secured, including:

- – Three-year VisionX contract with a Fortune 150 leading automotive retailer in the USA worth c.US$800,000

- – Three-year agreement with a large US tech company worth c.US$400,000

- – Two-year agreement with a prestigious Irish University worth c.€450,000

· Headcount increased by 75% to deliver the proprietary technologies of VisionX, Threathub and NoPhish

· Dedicated sales operation now established leading to a growing sales pipeline

· New Women in Cybersecurity Academy launched in August 2022

· Featured as a Fast 50 Technology Company by Deloitte Ireland in November 2022

Post-period end

· New and renewed contracts secured:

- – Existing contract with a global pharmaceutical client renewed for another year which is worth c.US$615,000

- – Contract secured with a new client – a global pharmaceutical organisation

- – New three-year contract worth over €100,000 with a leading climate solution company

- – Extended the scope of an existing contract with a Fortune 500 customer

- – Signed a letter of intent for a three-year contract with a major European financial services group

· Successful Zero Day Con 2023 conference held in March 2023

· Participation in new Managed Security Service Provider Program with partner, Forcepoint, a global security leader, announced in April 2023

· Shortlisted by Small Cap Awards for IPO of the Year and by Tech Excellence Awards for Managed Security Service Provider for the Year

· Grant of share options to employees

Financial highlights

· Revenues increased by 19.4% to €4.62 million (31 January 2022: €3.87 million)

· Adjusted EBITDA increased by 59.7% to €1.15 million (31 January 2022: €0.72 million) · Cash of €7.00 million at the period end (31 July 2022: €2.36 million

Raluca Saceanu, Chief Executive Officer of Smarttech247, commented:

“I am pleased to announce our first set of results as an AIM-quoted company. Smarttech247 is already seeing the benefits from its admission with continued revenue and EBITDA growth, and we are now well funded to support our expansion strategy. We are actively progressing with the delivery of our new products and traction with international customers is continuing to develop as evidenced by our growing sales pipeline.

“As Smarttech247 continues to establish itself as a key player in the cybersecurity sector, we are pleased with the progress made to date, and look forward to continued growth and strategic advances.”

Chief Executive Officer’s statement

Introduction and IPO

H1 2023 is the first reporting period for Smarttech247 as a PLC, quoted on AIM, a market operated by the London Stock Exchange. The Company was admitted to trading on 15 December 2022, successfully raising £3.7 million (before expenses) to fund the development of our proprietary technology and expansion into new products and geographies in order to accelerate revenue growth.

Operational review

During the period under review, Smarttech247 has continued to make significant progress, focusing on building out its platform and developing new products.

The Group has won a number of multi-year contracts with prestigious organisations which are doubly important as they provide validation of the service that Smarttech247 can provide and clear reference points for new customers whilst expanding our global market presence. These contract wins include a three-year contract with a total sales value of US$800,000 with a Fortune 150 leading automotive retailer in the USA with annual revenues of over US$20 billion. This was followed by a three-year agreement with a large US tech company headquartered in Massachusetts and a two-year agreement with a prestigious university in Ireland worth c.US$400,000 and €450,000 respectively over the length of these contracts.

More recently, we won a new contract with a global pharmaceutical organisation, and renewed a contract with an existing global pharmaceutical client for another year which is worth €615,000. We have also extended the scope of the contract with an existing Fortune 500 customer and secured a new three-year contract worth over €100,000 in total with a leading climate solution company. We have also signed a letter of intent for a three-year contract with a major European financial services group. The Company is often competing with larger global organisations to win new business and succeeding. The majority of our contracts are also multi-year thereby providing certainty of revenue.

To support the extensive capabilities of its VisionX Managed Detection and Response (“MDR”) platform, the Company launched its new VisionX technology during the period. The full VisionX platform comprises of an automated security operations centre platform providing 24/7 proactive threat detection and response, using cloud data analytics, machine learning and an incident response capability.

Combining the MDR platform with the managed services offering creates competitive differentiation for the Company which major new customers have highlighted as one of the reasons for selecting Smarttech247. The Company is also continuing to develop its threat and vulnerability software with Threathub. Threathub allows organisations to manage their risk in a continuous way by providing them with automated threat modelling and dynamic risk governance capabilities.

Smarttech247 works with several leading industry players whose products can be incorporated within its MDR platform as required. These partners include Forcepoint, Microsoft, IBM and Crowdstrike. The Group has also received re-certification to Cyber Essentials UK which validates the robustness of the Company’s data protection and cybersecurity systems.

One of our current areas of focus is to build out our sales strategy and operations. The Company is now making significant investments and progress in this area which will further support our revenue growth and this has been reflected in the growth of our sales pipeline.

On 9 March 2023, Smarttech247 hosted the Zero Day Con 2023 conference for the second time. This event brings together leading technology firms, industry experts and government officials to allow business leaders to learn more about the latest cybersecurity trends. This year was again a very successful conference with over 500 international cybersecurity industry participants attending, including representatives from the FBI and CIS.

In April 2023, the Company announced its participation in the newly released Managed Security Service Provider Program by its partner, Forcepoint, a global security leader. Smarttech247’s hosted and managed services centred on Forcepoint ONE SSE cloud-native and Forcepoint enterprise data security solutions which allows enterprises to manage risk holistically and simplify security operations.

Financial review

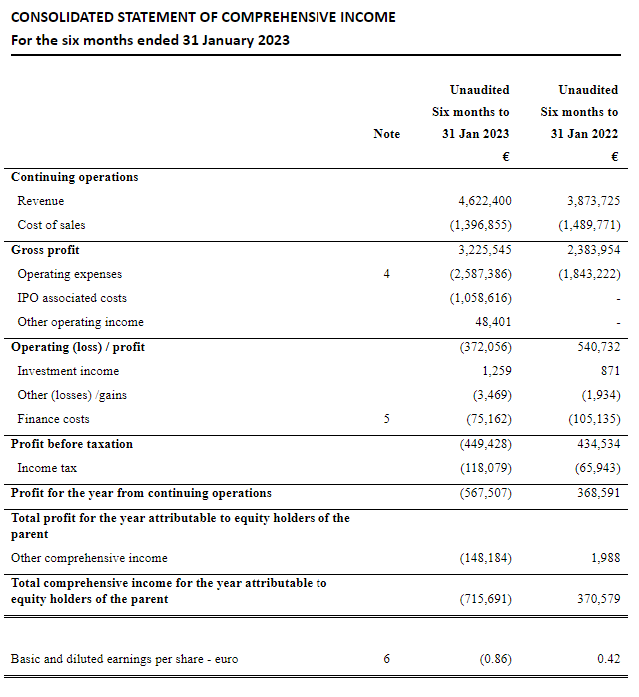

In terms of financial performance, revenue has increased by 19.4% over the prior period as a result of winning several new contracts. Gross profit and gross margins have increased reflecting the growth of the services component of our revenue mix.

Operating costs have increased, principally as a result of a growth in headcount as part of the build out of the platform and adjusted EBITDA (explained below) has increased by 59.7% compared to H1 2022. Certain of the Company’s costs continue to be capitalised as they relate to product development.

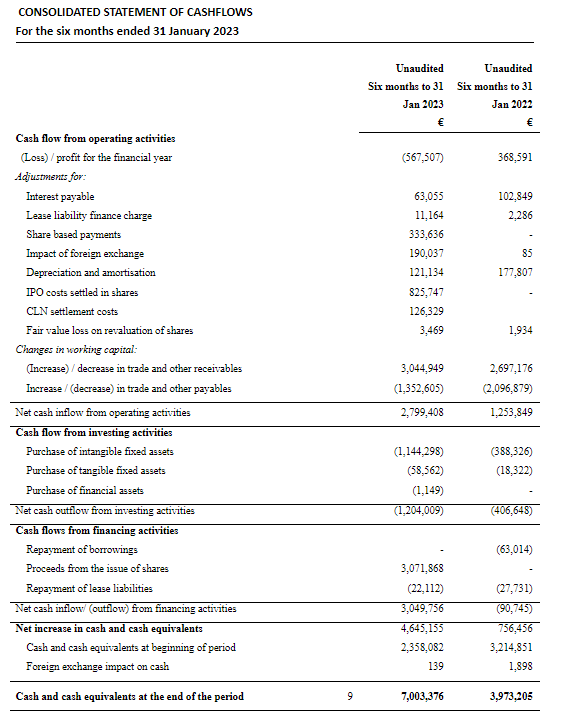

The costs of the IPO have been separately disclosed and have ultimately been settled from a combination of cash and new shares. Other exceptional/one-off items include the charge for share based payments and settlement costs relating to the conversion of the convertible loan note. These costs have been added back to EBITDA to calculate the adjusted EBITDA described above.

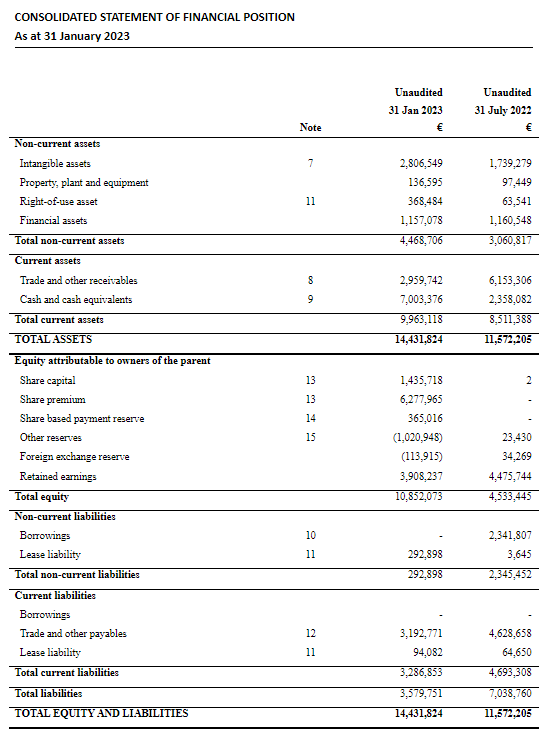

The convertible loan was fully converted on IPO in December 2022 leaving the Company debt free. The cash and net assets of the Company have therefore increased substantially, reflecting the conversion of the convertible loan and the new funds raised at the IPO. The Company is therefore very well positioned to fund its growth going forward.

Team

During the period, we have increased headcount significantly, by c.75% across all locations, in order to provide the capacity for future revenue growth and support product development. This is a significant achievement given the demand for suitably qualified high-quality personnel. Furthermore, the Company now has a new highly experienced sales team in place.

Outlook

We firmly believe that our AIM quote will enhance Smarttech247’s visibility and credibility in overseas geographies, including the USA and Europe, and will support our growth plans in the short and long term.

Cyber-attacks are on the increase with serious consequences for the companies involved. Smarttech247’s combination of artificial intelligence-led managed detection and response capabilities can help to significantly reduce the impact and manage the situation. With the threat landscape growing in complexity, exacerbated by geopolitical tensions, the Company is well positioned at the intersection of three major evolving growth markets; security threat incidents, cloud adoption and cyber-security data generation. Cloud mitigation is causing companies to redesign its systems, leading to new cyber-security requirements which Smarttech247 can mitigate. We therefore see clear opportunities for future growth using the platform that we have established.

Raluca Saceanu

Chief Executive Officer

27 April 2023

Significant non-cash items comprised:

- – Settlement of convertible loan note through issue of shares of €2,716,011

- – Issue of shares to the EBT to value of €122,036

NOTES TO THE INTERIM FINANCIAL STATEMENTS

For the six months ended 31 January 2023

1. GENERAL INFORMATION

Smartttech247 Group PLC (formerly Project Blackrock Limited) is a public company incorporated in England and Wales and has been admitted to trading on the AIM. The registered office address is 165 Fleet Street, London, United Kingdom, EC4A 2DY. The principal activity of the company and its subsidiaries (the “Group”) is the provision of threat intelligence with managed detection and response to provide actionable insights, 24/7 threat detection, investigation and response.

2. BASIS OF PREPARATION

This unaudited condensed consolidated interim financial information for the six months ended 31 January 2022 and 31 January 2023 has been prepared in accordance with IFRS as adopted by the United Kingdom, including IAS 34 ‘Interim Financial Reporting’.

The accounting policies applied by the Group include those set out in the preparation of the Historic Financial Information for the subsidiary company, Zefone Limited, as included within the Admission Document of the Group (“the Admission Document”), which can be found on the Company’s website.

There are no new standards, interpretations and amendments which are not yet effective in these financial statements, expected to have a material effect on the Group’s future financial statements.

The financial information does not contain all of the information that is required to be disclosed in a full set of IFRS financial statements. The financial information for the six months ended 31 January 2022 and 31 January 2023 is unreviewed and unaudited and does not constitute the Group or Company’s statutory financial statements for those periods.

The comparative financial information for the full year ended 31 July 2022 has been derived from the unaudited IFRS financial information included in the RNS release by the Group dated 4 April 2023.

The interim financial information has been prepared under the historical cost convention. The financial information and the notes to the historical financial information are presented in euros, the functional and presentation currency of the Group, except where otherwise indicated.

Merger accounting and consolidated financial statements

The Company was incorporated on 29 September 2022 with one £0.01 ordinary share and on 18 November 2022, became the parent company of the Group when it issued 87,499,999 £0.01 ordinary shares in exchange for 100% of the ordinary shares in Zefone Limited. This is not considered to be a business combination within the scope of IFRS3 as the transaction was between entities under common control. This is a key judgement, and as a transaction where there was no change in the shareholders or holdings, is accordingly accounted for using merger accounting with no change in the book values of assets and liabilities and no fair value accounting applied.

The consolidated financial statements present the results of the Company and its subsidiaries (“the Group”) as if they have always formed a single group for the entire period presented. Zefone Limited has been shown as the continuing entity and its comparative financial information shown for 2022. Intercompany transactions and balances between Group companies are therefore eliminated in full. The equity presented is that of Smarttech247 Group PLC with the difference on elimination of Zefone Limited’s capital being shown as a merger reserve.

A subsidiary is an entity over which the Group has control. The Group controls an entity when it is exposed to, or has rights to, variable returns from its involvement with the entity and has the ability to affect those returns through its power over the entity.

Share based payments

The Group has made awards of warrants and options on its unissued share capital to certain parties in return for services provided to the Group. The valuation of these warrants involved making a number of critical estimates relating to price volatility, future dividend yields, expected life of the options and interest rates. These assumptions have been integrated into the Black Scholes Option Pricing model and the Monte Carlo valuation model to derive a value for any share-based payments. These assumptions are described in more detail in note 14.

Share premium

The Share premium account includes any premiums received on the initial issuing of the share capital. Any transaction costs associated with the issuing of shares are deducted from the Share premium account, net of any related income tax benefits.

Going concern

The directors have considered the principal risks and uncertainties facing the business, along with the Group’s objectives, policies and processes for managing its exposure to financial risk. In making this assessment the directors have prepared cash flows for the foreseeable future, being a period of at least 12 months from the expected date of approval of this financial information.

Furthermore, the Company has successfully raised gross proceeds of £3.7 million in new equity in order to fund the continuing development of the business. The Group’s forecasts and projections based on the current trends in trading and after taking account of the funds currently held of over €7 million, show that the Group will be able to operate within the level of its cash reserves.

The directors therefore have a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future and consider the going concern basis to be appropriate.

3. SEGMENT REPORTING

The following information is given about the Group’s reportable segments:

The Chief Operating Decision Maker is the executive Board of Directors. The Board reviews the Group’s internal reporting in order to assess performance of the Group. Management has determined the operating segment based on the reports reviewed by the Board.

The Board considers that during the periods ended 31 January 2023 and 31 January 2022 the Group operated in the single business segment of Managed Detection and Response capabilities to global organisations.

4. OPERATIONAL EXPENSES

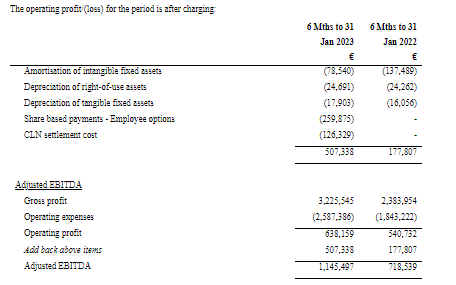

The operating profit/(loss) for the period is after charging:

The charge for share based payments relates to the issue of share options to the CEO on listing. Share warrants have been issued to pay for certain services in connection with the admission of the Company to AIM. Also, as part of the IPO process, the outstanding convertible loan notes were converted into equity which incurred a one-off associated cost.

5. FINANCE COSTS

6. EARNINGS PER SHARE

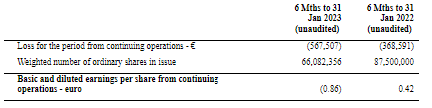

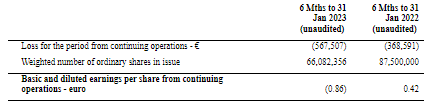

The calculation of the basic and diluted earnings per share is calculated by dividing the profit or loss for the period by the weighted average number of ordinary shares in issue during the period.

The weighted average number of ordinary shares in issued for the prior year has been used as the total number of shares swapped for the purchase of Zefone Limited as if those shares were on issue during the prior period.

There is no difference between the diluted loss per share and the basic loss per share as there were no securities in issue at 31 January 2023 that would have a dilutive effect on earnings per share.

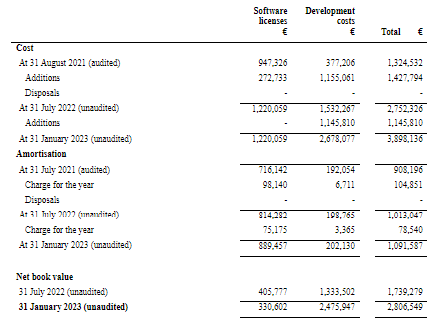

7. INTANGIBLE ASSETS

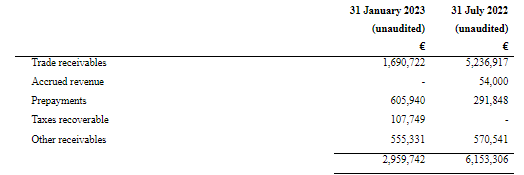

8. TRADE AND OTHER RECEIVABLES

9. CASH AND CASH EQUIVALENTS

Cash and cash equivalents consist of cash on hand and short term deposits held with banks. The carrying value of these approximates to their fair value. Cash and cash equivalents included in the cash flow statement comprise the following statement of financial position amounts.

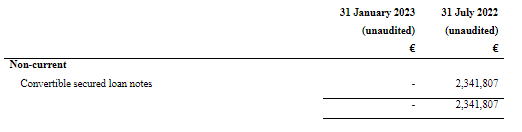

10. BORROWINGS

Convertible secured loan notes carry mandatory interest rate at 5% per annum. The Group shall redeem the outstanding loan notes on 7 May 2024 unless converted or repaid prior to that date (having been settled on the listing of the Group – refer below).

Holders of the convertible secured loan notes have the right to convert the loan notes into ordinary shares in the event of a sale or listing. The holder may also elect to convert the loan notes into ordinary shares prior to any such event based on a conversion rate.

The convertible secured loan notes are secured by a debenture incorporating fixed and floating charges over the Group’s assets both present and future.

During the period, the convertible loan note and associated interest was assigned to Smarttech247 Group PLC and settled by way of the issue of 13,646,441 on the listing of the Group – Refer to note 13.

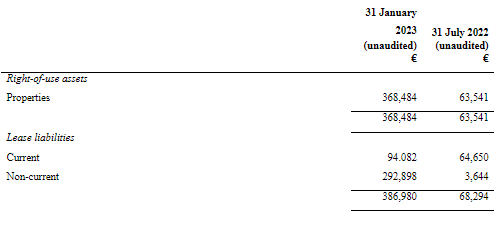

11. LEASES

The Group had the following lease assets and liabilities:

The increase in this balance for the current period relates to the renewal of the lease for the Cork office in November 2022.

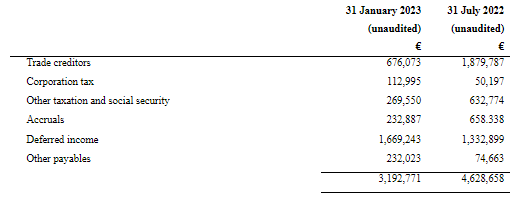

12. TRADE AND OTHER PAYABLES

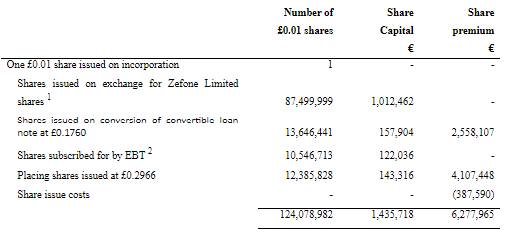

13. SHARE CAPITAL

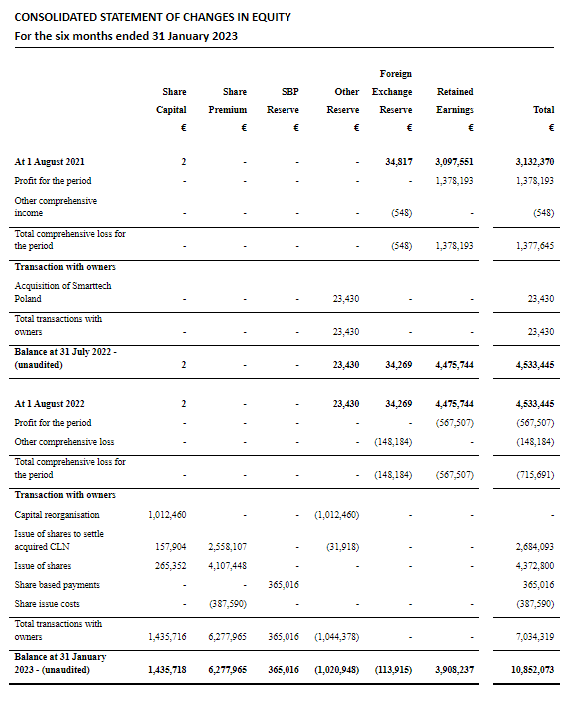

1 The issue of shares with a nominal value of €1,012,462 (£875,000) in exchange for the 2 £1 shares in Zefone Limited with a nominal value of £2 results on elimination of the difference in a credit to a merger reserve (within other reserves) of €1,012,462 (£875,000) in accordance with the merger accounting principles as set out in note 2.

2 During the period, the Company established a Group Employee Benefit Trust (“GEBT”) and issued 10,546,713 shares to the GEBT at nominal value.

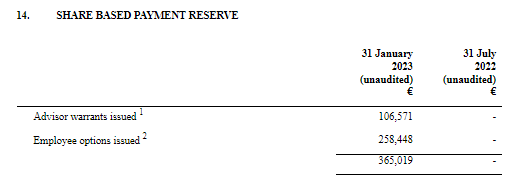

14. SHARE BASED PAYMENT RESERVE

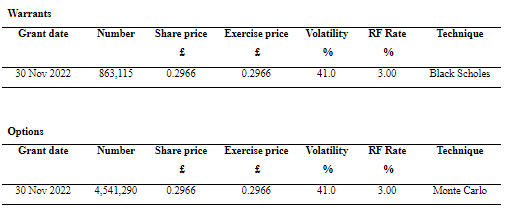

2 On 30 November 2022, 4,541,290 employee options were granted under the Group’s LTIP. These options have different vesting conditions based on performance milestones that can be viewed below.

Share based payments valuation

The following tables summarise the valuation techniques and inputs used to calculate the values of share based payments in the period:

On 30 June 2022, 4,541,290 employee options were granted under the Groups LTIP. The option vesting details are listed below:

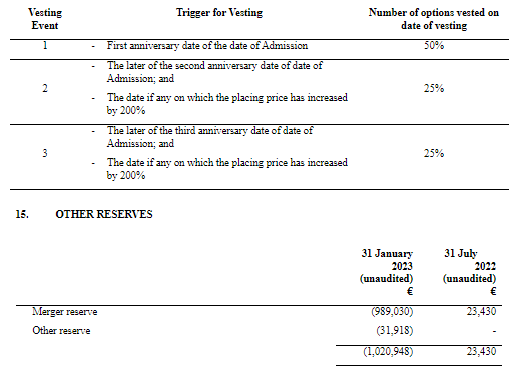

15. OTHER RESERVES

In the prior period, Zefone acquired Smarttech247 SP. Z O.O. for €2,112 (10,000 Polish Zloty) with the total identifiable net assets acquire being €25,550, resulting in the €23,430 being recorded to merger reserve.

As referred to in Note 2 above, on 18 November 2022, the Company became the parent company of the Group when it issued 87,499,999 £0.01 ordinary shares in exchange for 100% of the ordinary shares in Zefone Limited. Zefone Limited has been shown as the continuing entity and its comparative financial information shown for 2022. Intercompany transactions and balances between Group companies are therefore eliminated in full. The equity presented is that of Smarttech247 Group plc with the difference on elimination of Zefone Limited’s capital of €1,012,462 (£875,000) being shown as a merger reserve.

As part of the acquisition of Zefone Limited, Smarttech247 Group plc assumed the convertible loan from Zefone Limited and at admission issued 13,646,441 in full settlement of the convertible loan, with the resultant variance on settlement versus assigned value at time of assumption of the convertible loan of €31,918 taken to other reserves.

16. EVENTS SUBSEQUENT TO PERIOD END

There were no events subsequent to the period end that require disclosure.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.

END

Full RNS: https://www.londonstockexchange.com/news-article/S247/interim-results/15933684

Contact Us

The data you supply here will not be added to any mailing list or given to any third party providers without further consent. View our Privacy Policy for more information.